Wind Insurance

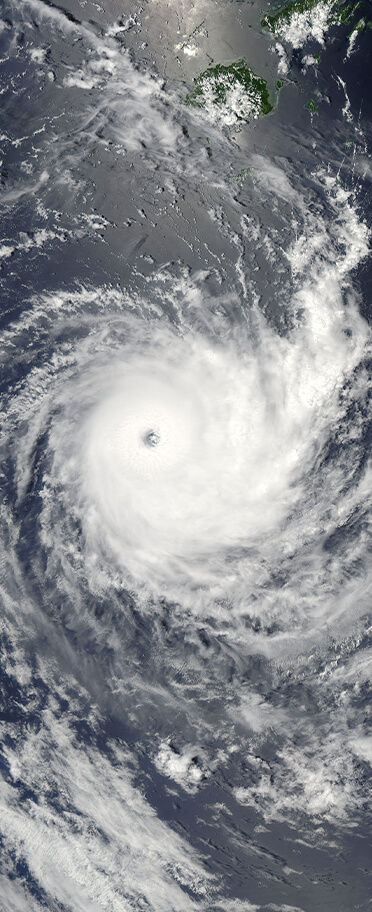

Most Florida residents will encounter a hurricane at least once, if not multiple times, throughout their residency. Windstorm insurance (sometimes called wind insurance) protects your home from damage caused by wind during a storm that the National Hurricane Center declares to be a hurricane. Florida law requires property insurance policies to include windstorm coverage.

Policyholders are eligible for premium discounts for installing certain wind resistant features on their homes. Additionally, a homeowner with windstorm insurance can often submit the results of a windstorm inspection to their insurer to obtain discounts on their windstorm insurance. In Florida, premium discounts for certain favorable wind mitigation features are mandated by state law and can total over 40% of the original policy’s premium.

The Florida legislature has created a state–run insurance safety net, titled Citizens Property Insurance Corporation (CPIC), to provide insurance to homeowners who cannot find insurance in the private market. CPIC is currently Florida’s largest insurer, covering 1.2 million policyholders.

Most Florida homes have at least one wind–resistive construction feature that makes them eligible for some windstorm insurance discounts. Additionally, Florida houses built after 1994 in Miami-Dade or Broward Counties, and houses built after 2002 in the rest of the State, have many wind resistive construction features and will likely qualify for credits. Contact us today if you are interested in reviewing your homeowners or wind insurance policy!